In the world of low-cost investments, companies like Vanguard Mutual Funds and Fidelity Investments have established themselves. Throughout the past thirty years, both businesses have managed billions of dollars in assets thanks to their low trading costs and low mutual fund management fees.

So where can I find the QLAC option at Vanguard and Fidelity? Nothing to be found? Keep in mind that an insurance company is the only entity that may underwrite annuities like the QLAC. The Qualified Longevity Annuity Contract (QLAC) is the only contract that offers a lifelong income guarantee.

Vanguard started providing income annuities, including QLACs, to its retail clients in 2016. However, in 2020, Vanguard announced that they would stop providing access for their investors to annuities, including ceasing to provide QLAC to baby boomers. Vanguard, a larger provider of annuities in the prior decade, has left the largest generational demographic, the baby boomers, high and dry. Guaranteed income is a key part of a retiree’s financial plan. Transamerica will administer the existing Vanguard investment-type variable annuities going forward. “While insurance-based options can be an appropriate choice … annuity administration is not central to our long-term product and service plans. We’re deepening our focus on our core priorities of delivering industry-leading funds and ETFs,” said Karin Risi, Managing Director of Vanguard’s Retail Investor Group.

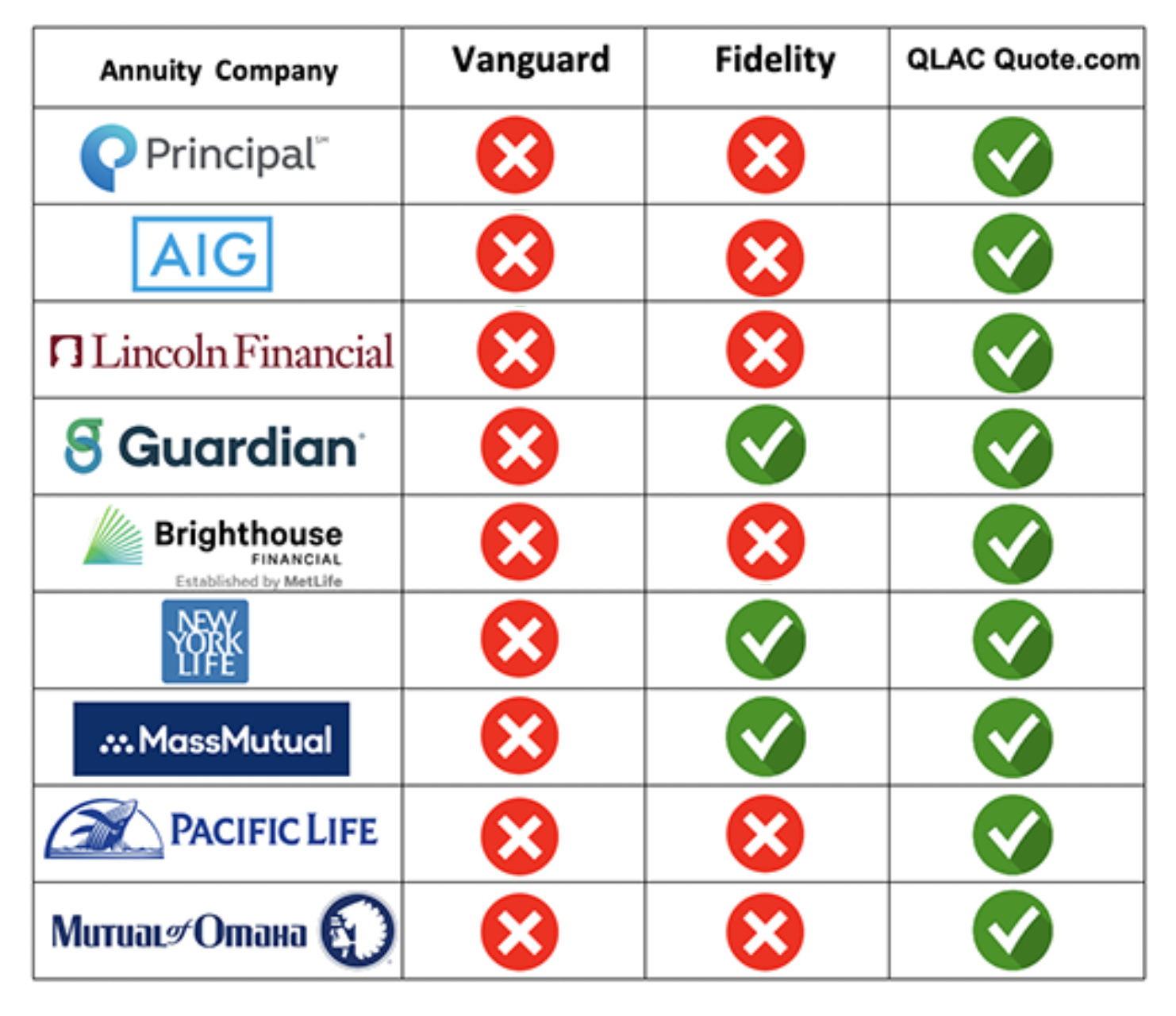

Currently, through Fidelity Insurance Network®, they have traditional commission-based QLACs from five out of eleven carriers. They are Guardian, Mass Mutual, New York Life, Pacific Life, and Western & Southern. The QLAC prices and income payments are the same as quoted from your neighbor’s agent next door vs. Fidelity directly. All eleven QLAC carriers have quotes on QLAC Quote.com. Visit www.QLACQuote.com to explore all QLAC providers and to get a free real-time QLAC quote. Here, we compare the best QLAC-approved businesses to determine your optimal income amount. To expedite your QLAC purchase, QLACQuote.com offers digital applications and transfer paperwork online. The IRA transfer to your new QLAC is a non-taxable event that is carried out via a straightforward form that enables the QLAC provider to communicate directly with your IRA custodian with your consent.

In 2024, Fidelity Investments intends to introduce a brand-new service that will enable workers to convert a portion of their employer-sponsored retirement plan into an annuity. The offering, called Guaranteed Income Direct, will enable participants in 401(k) and 403(b) plans to convert their retirement savings into a guaranteed stream of retirement income akin to pension payouts. There is no word if a deferred income annuity-like QLAC will be available, as it will have to be set up over 13 months in advance to receive income payments.

Fidelity claims that its Guaranteed Income Direct will enable employers to provide an immediate income annuity (SPIA) to employees through an insurer of their choosing. In a press release announcing the new product, Fidelity stated that it would offer digital tools through its employee benefits portal to assist employees in deciding how much-guaranteed income is appropriate.

Participants in the plan will be able to convert any amount of retirement savings into an annuity that will work like a “personal pension,” according to the company. Savings may be converted, regardless of whether they are invested in mutual funds, particular stocks, or other assets.

David Blanchett, the head of retirement research for Morningstar Investment Management, said he was somewhat surprised by the lower-cost providers’ latest move “because they are a leader in the online retail space” and “by doing this they are pairing back the suite of services they’ll be able to offer to their clients.”

The US Treasury Department made a QLAC (Qualifying Longevity Annuity Contract) law in the Federal Registry on July 2, 2014. This “qualified” longevity annuity was now tax-favored. The main benefit of the QLAC is to allow IRA owners up to $200,000 the ability to delay the required minimum distribution (RMD) requirement and not have to pay taxes on that income distribution until up to the maximum age of 85 if selected. The federal government realized that longevity and outliving your assets would be a strain on the Social Security system as people live longer lives. The QLAC incentive of tax deferral until income starts at the latest age of 85 and automatic guaranteed income payments could release the stress on social security.

Some details of the requirements to become a QLAC:

- Any 401(k), Defined Benefit, 457(b), Pension Plan, or 403(b) may be invested in a QLAC, as may any pre-tax IRAs, with the exception of Roth IRAs.

- As of 2023, a total investment in QLACs across all retirement accounts CANNOT exceed $200,000.

- The QLAC must begin income payments at the latest by age 85.

- The $200,000 will be adjusted in $10,000 increments for the Consumer Price Index (CPI), which measures inflation.

- Fixed income payouts must be provided by the QLAC; increases for the cost of living are a recognized alternative.

- The QLAC can have an optional “return of deposit” death benefit option before the income start date and also have a return of deposit death benefit after income starts. Installment refunds or lump sum death benefits are the two options available.

- Not having to take the required minimum distribution (RMD) every year after age 72 until age 85 gives the QLAC owner huge tax savings.

For a no annual fee QLAC and free quote see www.QLACQuote.com where we compare all QLAC approved companies to find you the highest income amount.

Questions or need more information?

Call us toll-free at (800) 325-1833