Today’s rates could be the highest rates you see for a very long time if you’re thinking of buying an

annuity.

Boomers are learning about the importance of securing guaranteed lifetime income and they are reaping

the benefits of a secure retirement. As more and more boomers approach retirement age and obtain

annuities to cover their basic expenses, this demand, coupled with increasing life expectancies can have

a dramatic effect on payout rates for future purchasers. Let me explain…

Last October, the Society of Actuaries (SOA) Retirement Plans Experience Committee (RPEC) released

the final report of the RP-2014 mortality tables. The updated tables display a consistent trend of increased

life expectancy. Dale Hall, managing director of research for the SOA stated that, “The purpose of the new

reports is to provide reliable data that actuaries can use to assist plan sponsors and policy makers in

assessing the financial implications of longer lives.”

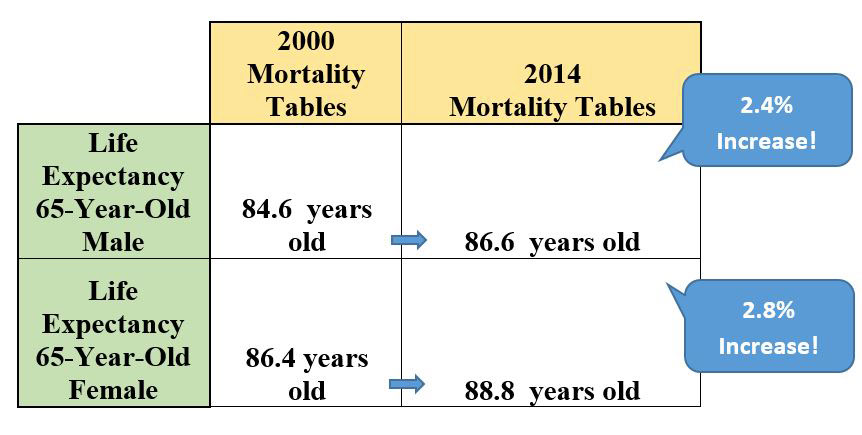

Let’s start by taking a look at the chart below, which highlights the differences between the 2000 Mortality

Tables vs. the 2014 Mortality Tables:

We see a 2.4 percent increase in life expectancy with 65 year old males and a 2.8 percent increase in life

expectancy with 65 year old females. If we were to continue on this trend, in 2028 we would anticipate to

see life expectancy rise to 88.6 years (for males 65 years old) and 91.2 years (for females 65 years old).

With increased improvements to medical technology, I predict that we will see significant additional growth

in life expectancy and should expect it to rise even greater than the trends indicate.

The updated mortality tables will require insurance companies to lower their payout rates in order to

properly reflect longer life spans. Boomers are in for a quite a shock when they see these adjustments coming. I’m talking about payout rates going from 14 percent to 10 percent, from 9 percent to

7 percent, and from 7 percent to 5 percent. These will not be small adjustments.

People are always asking me why they should buy an annuity in today’s low interest rate environment. I

say that today’s rates are not low. These are the new rates. Today’s rates could be the highest rates you

see for a very long time. Income annuities are really not an interest rate play. They are a longevity credit

play.

When it comes to lifetime income annuities, most people don’t realize how these products are able to

offer such high cash flows and payout rates. These humble annuities offers something that no other

product can offer: longevity credits, otherwise known as mortality credits. This is what separates income

annuities from other investment options.

Cash flow from an income annuity hails from three different sources: interest, a return of principal, and

mortality credits. Traditional investments can typically manufacture two of these components — interest

and return of principal. More importantly, only life insurance companies can manufacture mortality credits.

When payout rates for income annuities are released with the new mortality tables, you will see the

payout rates drop because of an adjustment in longevity credits. Combining the fear of outliving your

money and the uncertainty of the market, you and your clients need to lock in these guaranteed rates

now. These are likely the highest longevity credits you will see for the rest of your life.

Hurry, while supplies last

If the SOA only releases their mortality tables every 14 years, then you might be thinking, “I have a 14-

year window before rates re-balance, right?” Wrong. Many of these mortality adjustments will occur in the

coming months.

Here is another interesting fact: the life insurance industry has only a limited amount of longevity credits.

See, it is the life insurance on the books that provides the built-in hedge to lifetime income annuity sales.

As longevity increases and more people start “fishing” for longevity credits offered by income annuities,

the “longevity credit pool” begins to drain. This will also affect pricing of annuity products in the future.

Consistently educating yourself on the importance of covering 100 percent of your “minimum acceptable

level of retirement income” with guaranteed lifetime income is a must. This approach provides the most

cost-effective and practical way to provide for security in retirement, a matter that should be a top priority

for every boomer.

After covering basic expenses, you will need to put a significant amount of the remaining portfolio into

annuities and invest some into stocks, bonds, and money market funds. By securing annuities earlier in

retirement planning, you can lock in these longevity credits and optimize your retirement portfolio right off

the bat. Just like a day spent fishing, would you much rather cast off into a fully stocked pond as opposed

to a pond with a limited supply of fish?

Article originally posted at:

http://www.lifehealthpro.com/2015/05/12/longevity-credits-the-time-to-act-is-now