What is the better guaranteed income product for a retiree age 70 wanting guaranteed lifetime income at age 80; Index annuity or QLAC?

Most popular choice has been the index annuity with almost $50 billion of deposits in 2015. Allianz Life is the #1 carrier in indexed annuities, with a market share around 25 percent. American Equity Companies held on as the #2 carrier in the market; Security Benefit Life, Great American Insurance Group, and Athene USA followed-up in sales, rounding-out the top five. Allianz Life’s Allianz 222 Annuity was the #1 selling indexed annuity for the second consecutive quarter in 2015. These index annuities have an optional GLWB (Guarantee Lifetime Withdrawal Benefit) income rider usually for up to 10 years where income is guaranteed for an annually fee above 1%. Fewer and fewer index annuities have income riders that guarantee an income payment for life as the current low interest rate environment is to blame.

The product that got the “blessing” from the Treasury Department in 2014 is the longevity annuity also know as a QLAC (Qualifying Longevity Annuity Contract). This federally approved “blessing” allowed the RMD from IRA deposits to defer required minimum distributions until age 85. Usually a one-time deposit for a guarantee lifetime income at a future date chosen by the policy holder. QLAC options include inflation income adjustments of 1% -4% along with CPI-U, death benefits of deposit and joint annuitant for income.

-

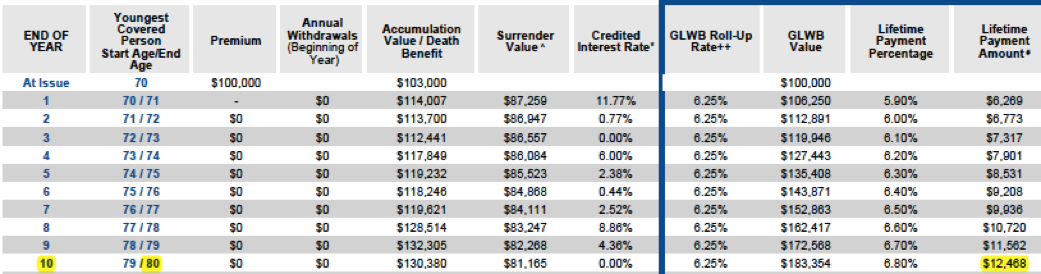

Index Annuity with Income Rider (6.25% ”roll up rate” annually for 10 year, 6.8% withdrawal rate at age 80) 10 years at age 80 lifetime income is $12,842 annually

-

QLAC or Longevity annuity 10 years at age 80 lifetime income is $15,950 annually

The QLAC also included a return of death benefit as the Index annuity also has the feature. There is a $3,108 annual income difference in favor of the QLAC for guaranteed lifetime income. By selecting the QLAC the retiree would receive over 24% more income for life. Also the RMD calculation was not included or discussed in this article. QLAC allows RMD to be delayed until age 85 as any other product, including the above investment, would require a RMD at age 70 ½ and beyond.

Annuities can be confusing but you need to know the information to make the correct retirement income decision. After all, annuities are long term investments with incredible retirement income advantages when correctly placed into your income portfolio.

For a no annual fee QLAC and free quote see www.QLACQuote.com where we compare all QLAC approved companies to find you the highest income amount.

* Rates and products not available in all states. For Illustration purposes only. See product illustrations for complete details. Rates run May 2016

interesting for a very long time